Learn and organize finance.

UX/UI Design

Mobile

20 Weeks

In a country with 70 million indebted people developing emotional and physical problems due to debt, the challenge arises: to help usual people to have control over their own money and to educate them financially in an accessible, simple and didactic way so that they can reach their financial independence.

I developed the project myself, using the Double Diamond methodology through four stages: Discovery, Definition, Development and Delivery.

Adaptability to Change

I learned to embrace change as research led Finis from finance education to account organization by understanding users’ real needs and pain points.

Active listening

I learned that silence encourages deeper insights. Giving space during interviews helped participants open up and share valuable information.

Unplugging

Letting go of features was hard, but tools like Impact vs. Knowledge and MoSCoW helped. I now use them even to plan my daily tasks.

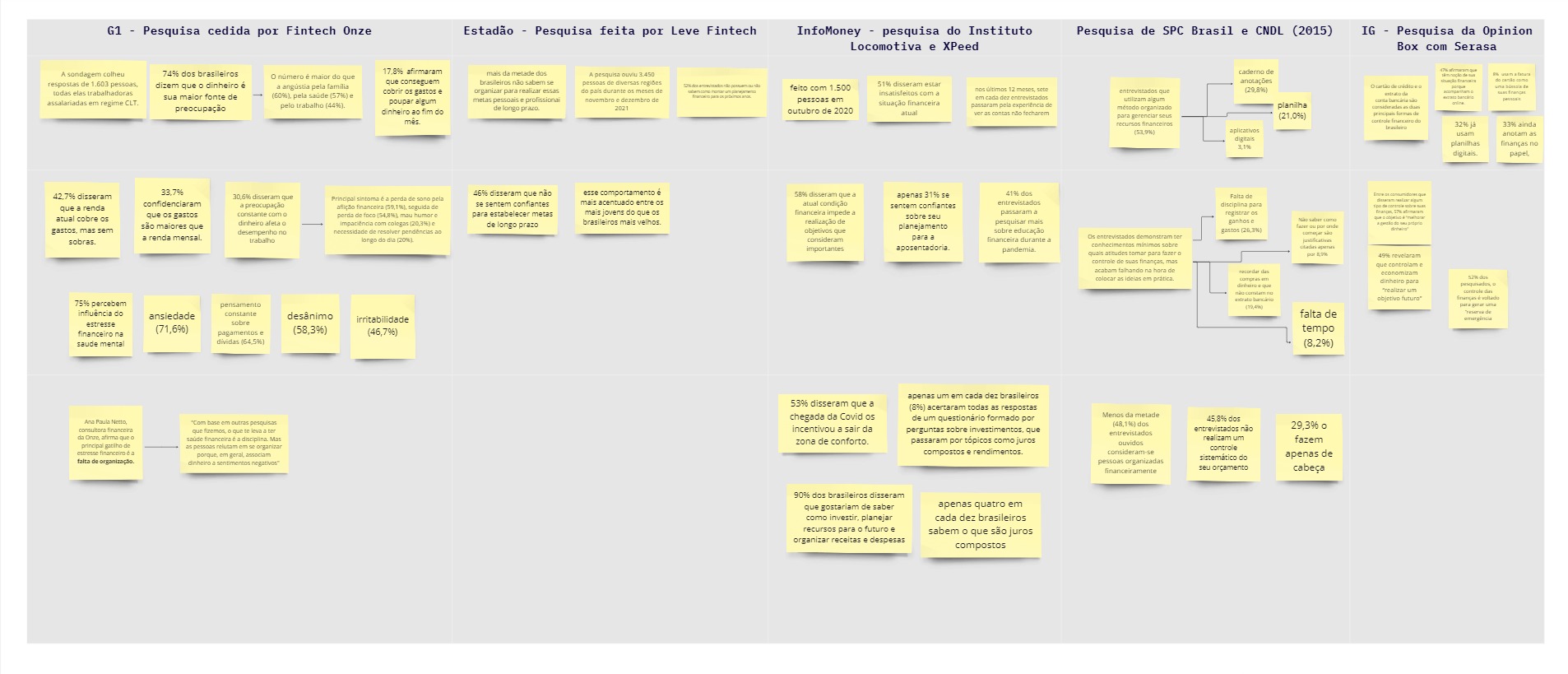

I conducted a desk research to understand debt in Brazil and people’s interest in learning about finance. I used a CSD matrix to identify information that still needed to be obtained and prioritized the most relevant ones. Then I conducted a quantitative research to understand how people organize their finances and learn. I interviewed some respondents to better understand their difficulties during these processes of organization and learning. Finally, I did a benchmarking to analyze features of direct and indirect competitors. The surveys have brought valuable insights into the target audience of the solution. The results revealed that the main challenge faced by users is the organization of accounts, rather than financial education. This discovery forced me to disengage from a possible solution that I had conceived at the beginning of the project and proceed in another direction.

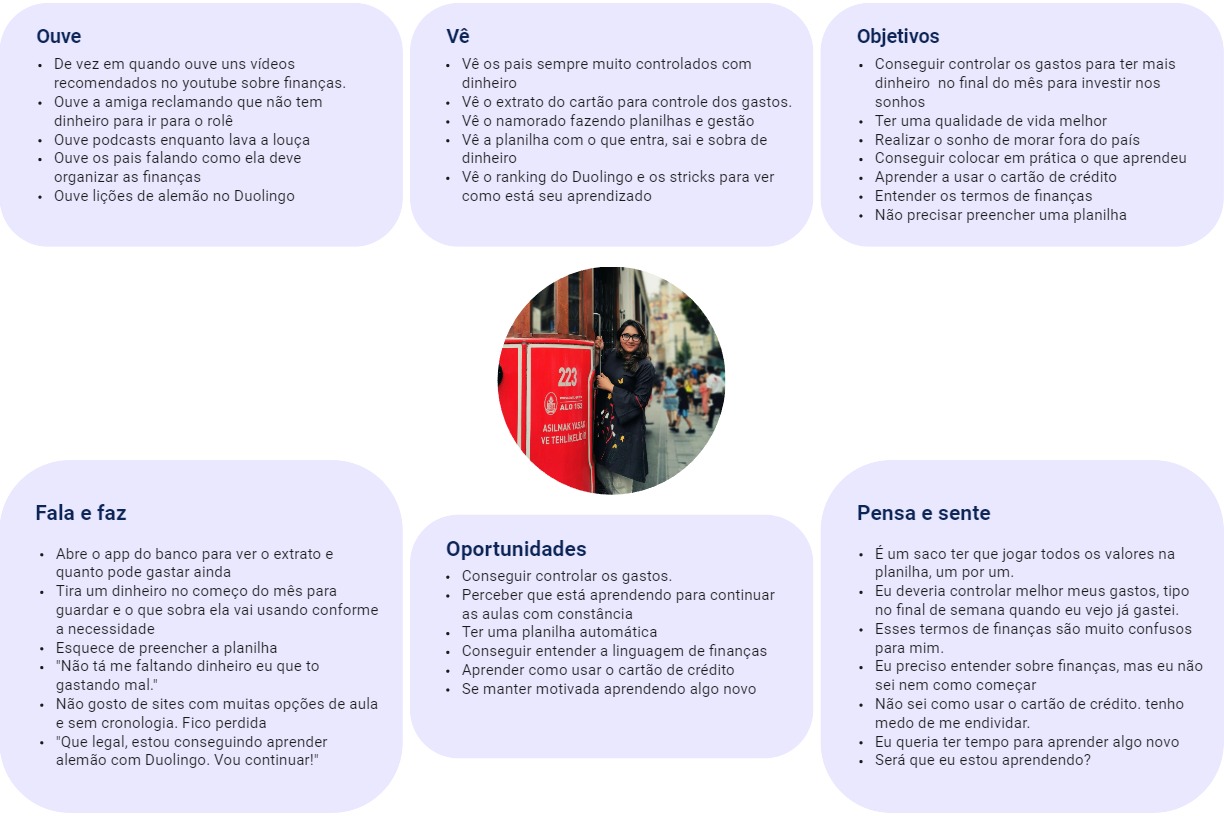

With the results of the research in hand, I began to draw my persona and identify its main pains and motivations that I set out in the map of empathy. I also traced the possible route my persona would follow until find Finis, making a User Journey. This helped me define the main problems that needed to be solved so that I could solve the difficulties of my persona and help her reach her dreams and goals. With the problems defined, I applied a brainstorming using How Might We to get ideas of how to solve each problem. I used the MoSCoW matrix to prioritize the most important features for that moment. With this, I managed to come up with a solution: a financial control application with an automated monthly spreadsheet and a budget setting option in addition to offering finance lessons with questionnaires to test knowledge.

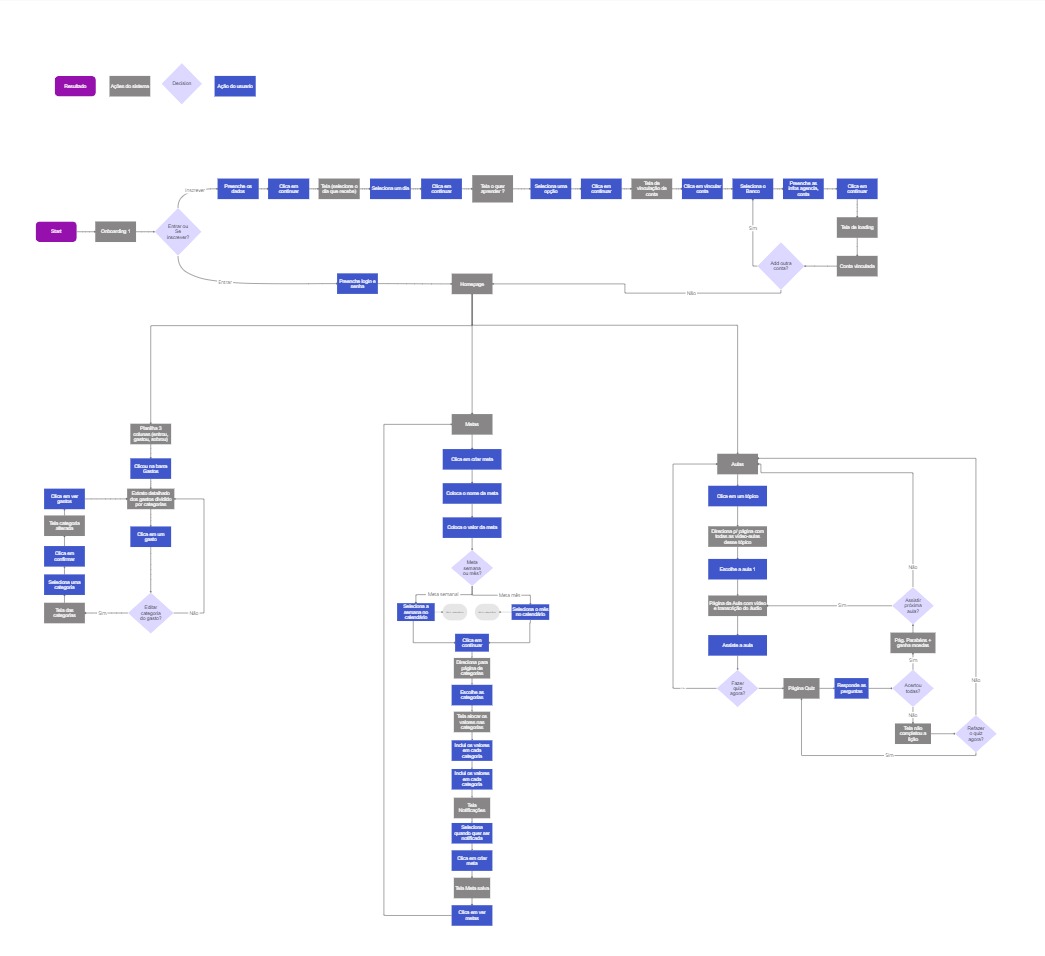

With the solution defined, I designed 4 user flows: one for onboarding, one for expenditure sheet, one to create a goal and one for finance class. From them, I was able to visualize the possible streams of users and draw the first drafts of the application. I made the first sketch on paper and then I switched to Figma assembling a medium-fidelity wireframe. Here, I used more realistic elements to be able to apply a usability test and see how users were using the app and what should be changed or improved. With the feedback from the test, I prioritized changing/improving the most urgent features, which undermine the usability of the application.

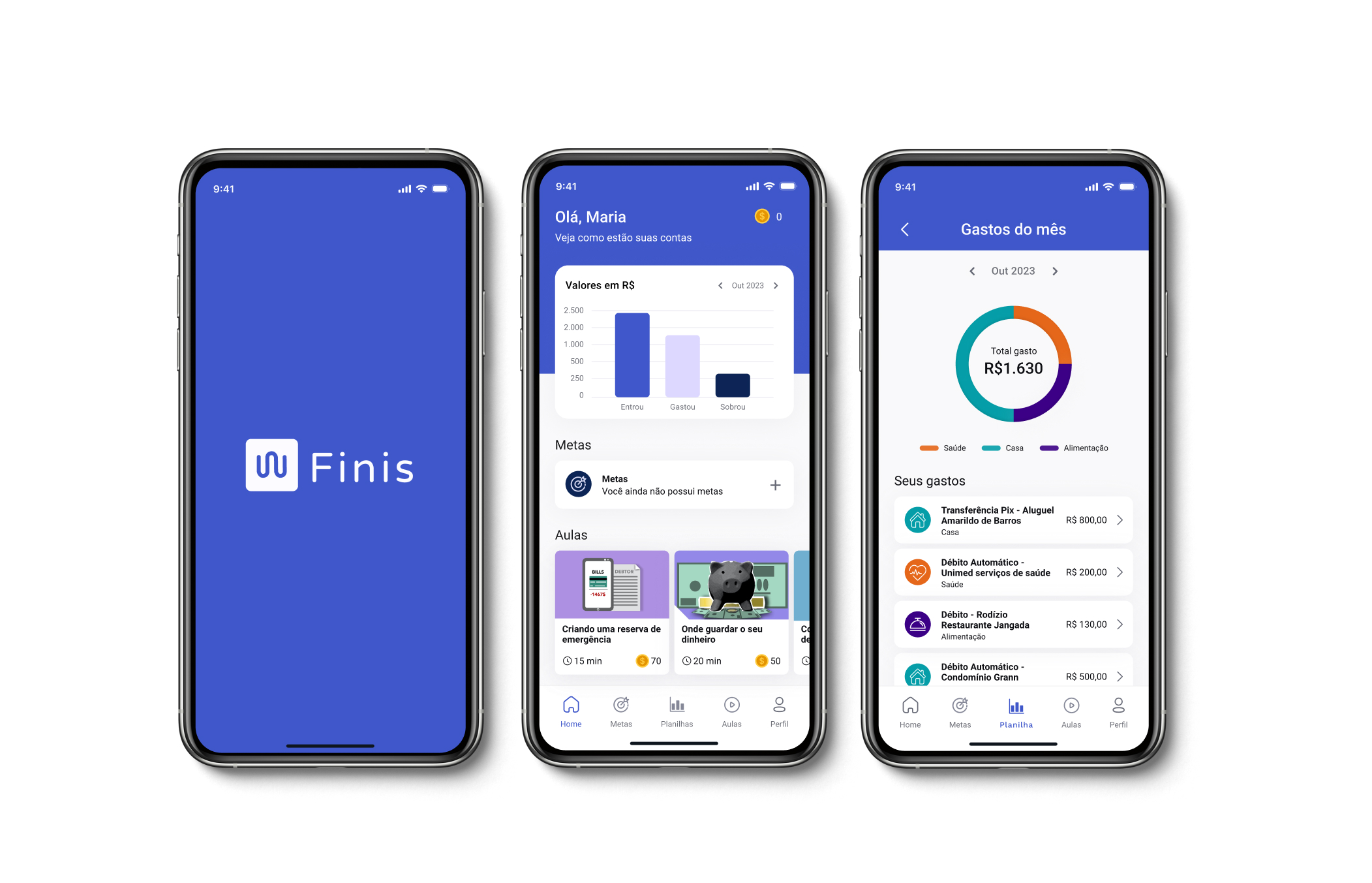

After prioritizing the features that needed to be changed, I started designing the app. Thinking about the brand communication that is intended to make the subject of finance lighter, I created a Style guide where I mounted a logo, buttons, chose the colors, typography, images and icons. Having done this, I started the navigable prototype made on Figma, already including the necessary changes that I obtained with the usability test.